Unfortunately, critical illnesses can affect a person at any age. These types of conditions can have a serious impact on a person and their loved ones, often changing how life looks for each of them. Additionally, it can be challenging to keep up with expenses after the diagnosis of a critical illness, putting further strain on a family unit. Thankfully, critical illness protection is a helpful solution for many. In this guide, you can discover everything you need to know about critical illness insurance and why it may be worth considering for you and your family.

What is Critical Illness Insurance?

To help you decide whether critical illness insurance is right for you, it’s worth knowing more about what it is and how it can be beneficial for many people. Below, you can learn the essential information you may need about critical illness insurance before making your decision.

Definition

Put simply, critical illness insurance provides financial protection to those with critical illnesses. Critical illness insurance can help to protect the policyholder and their loved ones, by helping to pay for the bills and covering costs while they rest or recover. The provider of critical illness insurance will typically pay out a lump sum of money if the applicable persons are diagnosed with one of the illnesses within the policy. As such, critical illness insurance is designed to take the weight off of a family while they manage the impact of a critical illness.

Types of Illnesses Covered

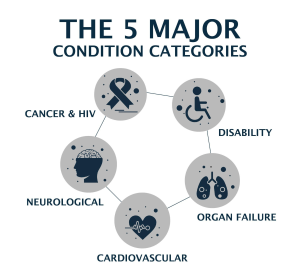

Unfortunately, there is no one set answer for which illness will be covered by a critical illness insurance policy. Some providers may offer critical illness insurance that excludes certain conditions, making it essential to speak to their team to discover their exact list before agreeing to their policy. Generally, critical illnesses refer to very serious conditions, such as heart attacks, and/or potentially long-term conditions such as cancer.

Some critical illnesses that many dedicated insurance policies will cover include:

-

Strokes

-

Alzheimer’s Disease

-

Cancer

-

Permanent disabilities

-

Heart attacks

-

Parkinson’s Disease

How It Works

As mentioned, each policy offered by insurance providers typically varies. This means their processes may also differ. Generally, however, critical illness insurance sees the policyholder making regular payments to the insurer. If the policyholder or other applicable person is diagnosed with a critical illness covered by the policy, they should be able to make a claim. Finally, the claim can be verified and a payment can be made.

Why Critical Illness Insurance is Valuable

If you’re unsure about whether critical illness insurance is right for your needs, it can be helpful to learn why this insurance is particularly beneficial. Read on to uncover some of the key advantages of critical illness insurance.

Financial Security During Health Crises

Financial security is particularly important during health crises, as in many cases a serious health condition can have a serious and palpable impact on household finances. Thankfully, critical illness coverage can help lessen the financial impact of your health condition by providing funds.

Peace of Mind for You and Your Family

Critical illnesses can be difficult for the entire family, often being upsetting and stressful simultaneously. It’s nice to know, therefore, that your family will be financially supported should anything happen to you. The protection critical illness insurance provides can offer your family peace of mind, giving them more time to concentrate on looking after one another through difficult times.

Complementary to Life Insurance

Critical illness insurance is not generally offered alone but is often available as an addition to life insurance policies. This combined approach means you receive both a death benefit from the life insurance policy and coverage for serious illnesses through the critical illness component, creating a more comprehensive safety net for you and your loved ones.

With the dual protection of life insurance and critical illness insurance, the policy can pay out for certain serious illnesses during your lifetime, providing financial support when you need it while still offering life insurance coverage to protect your family financially if you pass away.

How to Choose the Right Critical Illness Insurance Policy

As with any insurance policy, from car insurance to home insurance, it’s important to find one that will meet your needs and requirements. Below, you can discover some key criteria that will help you determine which policy that is currently available is most suited to you.

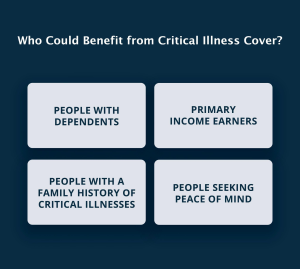

Identify Your Needs

Knowing what you need from a critical illness cover is arguably the most important part of choosing one that will work for you. Everyone will have different needs, meaning your and your family’s set of requirements will be unique to you. Consider what your wants and needs from a critical illness insurance policy are to help you narrow down which policies could potentially be right for you.

Consider the Additional Benefits

Many insurance providers offer additional perks with critical illness insurance policies, making it worthwhile to explore whether a potential provider offers added benefits that align with your lifestyle and needs. This could be a gym membership, for example, or discounted travel tickets.

Key Questions About Critical Illness Insurance

When it comes to determining which insurance provider to opt for, it’s worth asking any potential providers some direct questions beforehand. This can help you understand a bit more about the business itself, and eventually decide whether that particular policy is right for your needs.

What conditions are covered by critical illness insurance?

Typically, the best way to discover what critical illnesses are covered by a specific policy is to directly ask the specific provider. It’s always best to check with a potential provider, as you will want to know you and your family are protected in any potential situation.

What else should I know?

In many cases, it’s worth asking a potential provider what else they think you need to know. In doing so, you can learn particularly helpful or important information that helps to further inform your decision. This is also a great time to ask their team anything you are unsure about or to inform them if you’re feeling uncertain.

Why Choose Assura Protect for Your Critical Illness Insurance

At Assura Protect, we are a life insurance provider that aims to provide you with the right cover. There are plenty of reasons to choose our team to help you make sure your family is financially protected should the worst happen, which you can discover below.

24/7 Digital GP Services

No matter where you are in the world, we offer online doctor services at Assura Protect. As part of these services, we also offer e-prescriptions, referral letters and FIT notes to further help you. Our doctor-on-demand service will be able to offer you an appointment within 6 hours on average, making sure you get expert advice when you need it.

Policyholder Benefits

With the Assura + Protect policy, we offer multiple membership benefits for our policyholders too. This can include gym discounts, travel discounts, and more. These comprehensive benefits can be advantageous in daily life and are accessible through our Annabel app.

Ease of Access

Included in our services is your digital insurance partner, known as Annabel. This online system is accessible through our app, which you can use to unlock benefits and rewards. This means our services are only a few taps away, at all times.

Securing Your Future with Critical Illness Insurance

If you’re interested in our critical illness insurance policies at Assura Protect, our team would be happy to help you learn more. Please visit our website to discover more about us at Assura Protect and the life insurance policies we can offer you. For further information or an insurance quote, please get in touch with our friendly team directly today.