When it comes to protecting your health and financial future, understanding the differences between a critical illness policy and health insurance is essential. At Assura Protect, we specialise in providing tailored life insurance solutions that help you feel secure, no matter what life throws your way.

While both types of cover are vital, they serve different purposes. Whether you’re looking to manage healthcare costs or protect your finances during a serious illness, this guide will help you understand how critical illness policies and health insurance compare, and how combining them can provide comprehensive protection.

What Is a Critical Illness Policy?

A critical illness policy provides a lump-sum payment if you’re diagnosed with a serious illness that’s specified in your policy. This payment offers financial relief during difficult times and can be used for any purpose, not just medical expenses.

Key Features

-

Coverage for Serious Conditions: Includes illnesses such as cancer, heart attacks, strokes, certain disabilities, and more.

-

Flexible Financial Support: The lump sum can be used to cover lost income, mortgage or rent payments, private care, or even home adaptations.

-

Peace of Mind for You and Your Family: Reduces financial stress so you can focus on recovery.

At Assura Protect, our Multi-Claim Critical Illness Cover allows you to make claims for different illnesses over time, offering ongoing financial protection no matter what life has in store.

What Is Health Insurance?

Health insurance is designed to cover the costs of private medical care, ensuring you can access treatment without worrying about immediate expenses. It’s ideal for managing everyday healthcare needs and unexpected medical emergencies.

In the UK, many choose not to take out health insurance as they are happy to utilise the free services provided by the NHS. However, plenty of people do opt for private healthcare, for various reasons – in these cases, health insurance can be invaluable.

Key Features

-

Comprehensive Medical Coverage: Covers hospitalisation, surgeries, medications, and specialist consultations.

-

Added Benefits: Many policies include perks like online GP appointments, mental health support, and preventative care services.

-

Ongoing Healthcare Support: Ensures you can access treatment whenever you need it, reducing delays in care.

How Do These Options Differ?

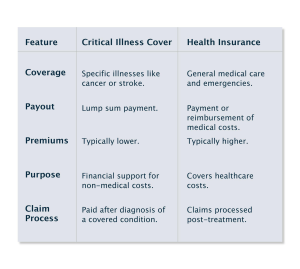

While both types of cover offer valuable protection, they cater to different needs. Here’s a quick comparison table, followed by a detailed breakdown of their key differences.

Scope of Coverage

Critical Illness Policy: Covers specific serious illnesses listed in the policy terms. It doesn’t provide ongoing healthcare support.

Health Insurance: Offers broader coverage, including routine care, emergency treatments, and diagnostic services.

Payout Structure

Critical Illness Policy: Pays a lump sum upon diagnosis of a covered illness. This payment is flexible and can be used for any purpose.

Health Insurance: Covers or reimburses the cost of medical treatments, directly addressing healthcare expenses.

Cost of Premiums

Critical Illness Policy: Generally has lower premiums because coverage is limited to specified illnesses.

Health Insurance: Premiums tend to be higher due to comprehensive healthcare coverage.

Purpose

Critical Illness Policy: Provides financial security during a serious illness, helping you manage the broader impact of your diagnosis.

Health Insurance: Ensures access to necessary medical care without significant out-of-pocket expenses.

Claim Process

Critical Illness Policy: Requires diagnosis of a covered condition. Once verified, a one-off lump sum is paid.

Health Insurance: Claims are processed after receiving treatment, with the insurer reimbursing costs or settling directly with healthcare providers.

Combining Critical Illness Cover and Health Insurance

By combining these two types of cover, you can create a comprehensive protection plan that addresses both your medical and financial needs.

Benefits of Combining

-

Complete Coverage: Health insurance covers immediate medical costs, while critical illness provides financial support for non-medical expenses.

-

Financial Flexibility: Use the lump sum to manage household bills, recovery costs, or even a family holiday to aid recuperation.

-

Peace of Mind: You’re protected from both the financial and health-related challenges of serious illnesses.

At Assura Protect, we can help you understand how to layer your insurance policies for optimal coverage, tailored to your needs.

How to Choose the Right Insurance Plan

Selecting the right insurance plan requires careful consideration of your circumstances and goals.

Assess Your Needs: Think about your family’s financial situation, your current savings, and any existing health risks.

Set a Budget: Determine what you can afford to pay for monthly premiums while balancing your overall expenses.

Review Policy Terms:

-

For critical illness policies, check the list of covered illnesses and exclusions.

-

For health insurance, look for additional benefits like mental health support or online GP appointments.

Seek Expert Advice: Our team at Assura Protect is here to guide you through your options and recommend the best solutions for your needs.

Assura Protect’s Multi-Claim Critical Illness Policy

When it comes to critical illness policies, our Multi-Claim Critical Illness Cover sets us apart. Designed to provide both life and critical illness protection, it offers multiple layers of financial security that go beyond traditional policies. This unique approach ensures you’re covered no matter what life throws your way.

Why Choose Our Multi-Claim Cover?

We understand that serious illnesses don’t just impact your health – they can also put a significant strain on your finances. That’s why we’ve created a policy that provides the flexibility and support you need during challenging times.

Comprehensive Coverage for Major Conditions

-

Our policy covers 40 major conditions, including cancer, cardiovascular diseases, organ failure, neurological issues, and disabilities.

-

We also include protection for 6 partial conditions, such as low-grade cancers like breast, prostate, and thyroid, ensuring broader coverage.

-

The policy also includes Accident Cover and Child Critical Illness Cover, should you need it.

Multi-Claim Capability

-

You can make up to three claims for different major conditions, offering ongoing financial security.

-

Our payout structure is designed to provide substantial support:

-

First and second claims: 75% of your sum assured.

-

Third claim: 50% of your sum assured.

-

-

This means you could receive up to 200% of the initial sum assured across multiple claims.

Our online multi-claim calculator can help you determine potential benefits and cover available.

Life Cover That Continues

Unlike many policies that end after a critical illness claim, our Multi-Claim Cover keeps your life cover active, ensuring your loved ones are still protected with a death benefit.

Additional Benefits for Your Peace of Mind

Doctor-on-Demand: Access online GP appointments anytime, anywhere in the world.

Annabel App: Enjoy exclusive perks like retail rewards, concierge services, and access to premium publications with our Annabel App.

A Policy That Adapts to Your Needs

Our Multi-Claim Cover isn’t just about providing a financial safety net – it’s about supporting you through life’s ups and downs. By offering flexibility and allowing for multiple claims, we’ve created a policy that evolves with you, ensuring you’re never left unprotected.

Below are just two examples of how our policy can help you through various scenarios – consult our Multi-Claim User Guide for more:

Comprehensive Critical Illness Cover from Assura Protect

Both critical illness policies and health insurance are essential tools for protecting your financial future and ensuring access to quality care. By understanding their differences and benefits, you can choose the right combination of cover to suit your needs.

At Assura Protect, we’re here to help you take the first step in securing your future and ensuring you’re prepared for whatever challenges life may bring. Visit our website or contact us today to explore your options and find the perfect plan for your circumstances.