Joint Cover Life Insurance: Is It the Best Option for You and Your Partner?

Thinking about life insurance for yourself and your partner? You’re not alone. There are many life insurance benefits to reap and it’s a vital part of financial planning for couples, but with so many options available, it can be confusing to know where to start.

In this article, we’ll dive into the world of joint cover life insurance. We’ll explore what it is, how it works and, most importantly, whether it’s the right choice for you and your partner.

As you explore life together, you’re likely building a future filled with hopes and dreams. But what happens if the unexpected occurs? Joint cover life insurance can provide financial security for your loved one if you’re no longer there and vice versa.

Let’s navigate this essential topic together and ensure you make an informed decision about your future.

What is a Joint Life Insurance Policy?

A joint life insurance policy is one that covers two individuals. This means that, should something happen to one of these individuals whilst covered by such a policy, the other will receive a payout. On top of this, both individuals can share the cost of the premiums of a joint cover policy.

A joint policy can be taken out by any two individuals, regardless of marital status. This means that friends, family members or even business partners can take out a joint policy together. With that said, joint policies are often utilised by couples in particular.

Joint Life Cover vs Single Life Cover

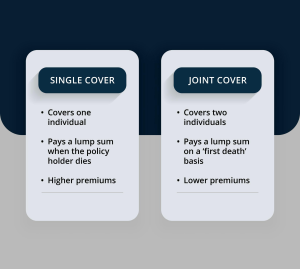

If you’re considering life insurance options for you and your partner, then you may be weighing up your options on whether a joint cover policy or two single life cover policies might be better. So, let’s take a look at the differences between the two:

-

Cover: Single policies offer cover to a single individual, whereas joint policies cover two individuals.

-

Payout: In a single policy, a lump sum is paid out when the policy holder dies, either into their estate or to their nominated beneficiary (if the policy is placed in a trust). In a joint policy, a lump sum is often paid out on a ‘first death’ basis, meaning it will be paid out after one of the covered individuals dies, or if both die at the same time.

-

Premiums: Premiums for a joint cover are often more affordable to cover between two individuals than covering the premiums for two separate, single cover policies.

The Pros and Cons of Joint Life Insurance Cover

Pros

Affordability

Joint insurance policies commonly tend to be more affordable compared to single policies for the same level of cover. This is because the premiums can be split between your couple, rather than having to cover two separate premiums for two single cover policies.

Suitability for Shared Finances

Many couples often share a number of significant financial responsibilities associated with running a home, such as splitting the bills and both contributing to a mortgage. Should you take out a joint policy, then the payout received could be used to pay off the mortgage in the event that one partner dies.

Speed of Payout

When it comes to making a claim, making a claim on a joint policy can often be quicker and easier than taking out a claim against a single policy. This is because the payout is sent directly to the surviving partner covered on the policy, whereas with a single policy it is instead paid into the deceased’s estate and may be subject to inheritance tax, unless placed into a trust beforehand.

Cons

Level of Cover

One of the main drawbacks of joint life cover is that most joint life policies only pay out on a first death basis. This means that, after the first person out of the two who are covered dies and the payout has been made, then the surviving individual will no longer be covered. This means that they would need to take out a new, single cover policy should they wish to continue being covered by life insurance for themselves.

Only One Payout

As we just mentioned, joint cover policies tend to operate on a first death basis, meaning there is only a singular payout, after which the surviving individual would need to take out a new, separate policy if they wished to remain covered.

Should you and your partner instead decide to both take out single cover life insurance policies as opposed to a joint one, then it’s guaranteed that a payout will be made after both your deaths (as long as these occur within the duration of the policies).

Splitting a Policy

Whilst no couple ever plans for it to happen, there is still always a possibility that your partnership may break down and you decide to split. If you decide to take out a joint policy together and it does happen that you end up deciding to split, you may find that it is expensive or even not possible to split the policy, also.

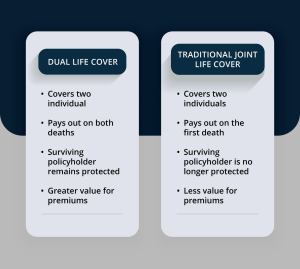

Introducing Dual Life Cover from Assura Protect

Here at Assura Protect, we’re committed to providing our customers with comprehensive insurance coverage that meets modern requirements. That’s why we’re proud to offer our dual life cover, taking traditional joint cover and elevating it to better suit your needs.

Unlike traditional joint cover that only makes a single payout after the first death, our dual life cover continues to cover the second individual after the first individual dies. This means that two payouts will be made, and there is no need for the surviving individual to take out a new policy in order to remain covered.

Ultimately, this offers comparatively greater value for premium with twice as much effective cover. So, if you and your partner are looking for a cost-effective, comprehensive life insurance solution, then consider our dual life cover here at Assura Protect.

Choosing the Right Option for You

As you can see, there are various levels of life insurance cover available, each of which differ in the benefits they offer. When choosing to take out life insurance with your partner, there are various factors to take into consideration, such as your finances and the level of cover you’re looking for, before deciding which option may be best for you.

If you think the dual cover life insurance offered by us here at Assura Protect might be a good fit for you, then get in touch with us today to retrieve your insurance quote, or use our online quick quote service.