Insurance companies will base your life insurance quote on a number of factors. This normally means when browsing for a policy you will not be able to see a price until inputting details about yourself and your situation. An insurer will take into account information such as age, health, relationship status, policy coverage amount and more when deciding a price.

Here at Assura Protect, we can provide life insurance policies for the modern era, including a range of membership benefits and comprehensive coverage. We have put together this helpful guide on 10 common factors that may affect your life insurance quote.

-

Age

The first factor that may affect your life insurance quote is your age. Younger policyholders will typically pay lower life insurance premiums, with older policyholders typically paying more. This is because, statistically, the younger you are the more likely you will have time to pay on your policy.

The price of your quote may increase as you age, and past a certain age, you might even find it challenging to find an insurer willing to offer you a life insurance policy, with many companies setting a maximum age to take out their policies.

-

Health

The next factor that may affect your life insurance quote is your health. It is important to be honest with your health when it comes to your policy, disclosing any history of medical conditions such as heart disease, high blood pressure, cancer or diabetes. Insurers will also check your family medical history as well, as patterns of severe illness or hereditary disease can lead to higher policy quotes.

Your premium may be higher than for someone with a clean health history, and if your condition is life-threatening, an insurer could deny coverage altogether. Some insurers may require a medical exam before issuing the policy to ensure the price they offer is right.

-

Occupation

Your occupation will also be a factor when it comes to a life insurance quote, as those in a high-risk career are typically more likely to have an accident or pass away. Careers that are deemed high-risk include firefighters, active service members, miners, roofers, steelworkers and police officers.

-

Lifestyle

Leading on from this, the life you lead can also affect your life insurance policy. If you regularly engage in risky activities such as mountain climbing, motorsports or others like this, insurers may consider their potential impact on your health.

They will also take into account the habits you carry out. If you are a smoker or a heavy drinker, this can impact your life insurance policy. They might also take into account if you have a high BMI, as this could be deemed as high risk in an insurer’s eyes.

Some insurers might lower your rates further down the line if you show a commitment to stopping dangerous activities and living a healthier lifestyle, however, this is not always the case and can depend on the insurer.

-

Gender

Gender can also affect your life insurance quote, as the life expectancy for women tends to be higher than for men. The average life expectancy for a woman is around 80 years, whilst a man’s is around 75. Overall this should not affect your policy if taking it out at an early age, but could be taken into account as you age.

-

Travel Habits

Whilst you won’t be penalised for going on holiday every now and again, you might be considered high risk if you frequently spend long periods of time in areas that are deemed high risk, such as Russia or Ukraine. Even if this is for work, your premium might be higher because of this.

-

Length Of Policy

The duration of your policy will likely affect the cost of the cover. Having a policy for 10, 20 or 30 years is drastically different, and it’s more likely you’ll be paying more in monthly premiums because of this.

-

Type Of Policy

Insurers normally offer bespoke policies for individuals, couples and groups. The type of policy you choose will depend on what you need and how much you can afford for the policy. Here are the options offered by Assura Protect:

Term Life

Term life insurance allows you to make regular premium payments to use in exchange for a defined benefit upon death. The benefit payments are tax-free and can be used for any purpose, designed to provide financial protection to your dependents, pay off any outstanding loans and cover funeral costs.

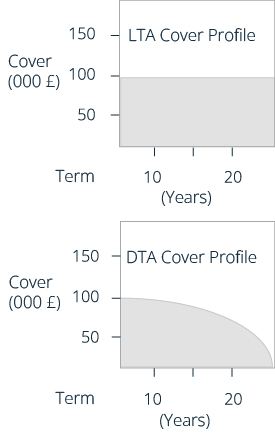

There are two types of term life, with the first being Level Term Assurance. This is where the premiums and the amount of coverage stay the same during a policy term, regardless of when the insured person passes away.

The second option is Decreased Term Assurance, which is where your cash sum assured decreases in a similar fashion to the way a repayment of a mortgage decreases the outstanding mortgage amount. The premiums are fixed but tend to be lower due to the fact the coverage decreases over time.

Multi-Claim Critical Illness Cover

Traditional critical illness policies often offer a single lump sum benefit on an initial claim, however here at Assura Protect we offer a more modern solution where you can make more than one critical illness claim with multi-claim cover. Conditions can cover cancer and HIV, organ failure, neurological issues, disabilities and cardiovascular issues.

Dual Life Cover

Shared financial planning is the common way that many partnerships operate. This is why most people with partners operate for joint life cover, to help protect both of you and provide shared security. However many joint life policies only consider when one partner passes away, providing only a single death benefit payment.

We are proud to offer Dual Life Cover, which has several advantages over a typical joint life policy. We insure each partner separately, paying a benefit on both deaths and not just the first. If one person passes away, the protection for the survivor remains in place. Separate beneficiaries can also be nominated for each benefit payment, thereby simplifying estate planning. Dual Life is available on all Assura Term Life and Multi-Claim Critical Illness policies.

Life Insurance Policies From Assura Protect

If you are in need of a modern life insurance provider, work with Assura Protect to find the ideal solution for you. We are able to provide a range of great life insurance options, including up to 200% multi-claim critical illness cover and 200% dual life cover. We pride ourselves on our modern alternatives to traditional joint life protection, covering both lives and not just whoever passes away first.

One way we stand out from other insurance providers in the field is our membership benefits. As well as your policy, you’ll get access to Annabel Rewards, your digital insurance partner. On this app, you’ll gain access to exclusive benefits from top brands, including cash back and discounts across various industries. As well as this you’ll get access to our Doctor-on-Demand services, which enable you to speak to a doctor online from anywhere in the world.

If you’d like to find out more about how we can help, feel free to contact us today. Or apply for a quick quote to find out what option will suit you best.