Everyone wants to make sure that their loved ones are protected financially, which means that choosing the right insurance plan is essential. But with so many options available, it’s easy to feel overwhelmed. One common dilemma is deciding between life insurance and mortgage life insurance. While both provide financial security, they serve different purposes. So, which one is right for you? In this guide, we’ll break down the key differences, pros and cons and help you decide based on your individual needs.

What is Life Insurance?

Life insurance is a broad term that refers to a policy designed to provide a lump sum payout to your beneficiaries if you pass away during the term of the policy. The funds can be used for various purposes, including covering daily living expenses, repaying debts or securing your children’s future.

Types of Life Insurance Plans

There are several different types of life insurance, including:

Term Life Insurance

Covers you for a specified period, such as 10, 20 or 30 years. If you pass away within the term, your beneficiaries receive the payout.

Whole Life Insurance

Offers lifelong coverage with a guaranteed payout, often including an investment component.

Modern Life Insurance

Policies that adapt to changing financial needs, offering flexible premiums and coverage amounts.

Joint Life Insurance

Covers two people under a single policy, often paying out on the first death.

Critical Illness Cover

Some life insurance policies also include critical illness cover, paying out if you’re diagnosed with a serious illness.

What is Mortgage Life Insurance?

Mortgage life insurance is specifically designed to cover your outstanding mortgage balance if you pass away before paying it off. This means your family won’t have to worry about losing their home due to financial hardship.

How It Works

-

The payout decreases over time, matching your mortgage balance.

-

The beneficiary is usually the mortgage lender, not your family.

-

It means your mortgage is repaid in full, so your family can remain in their home without added financial burden.

Mortgage life insurance is often offered when you take out a mortgage, but it’s not essential. Some lenders may suggest it as a requirement, but you are free to choose a policy that best suits your needs.

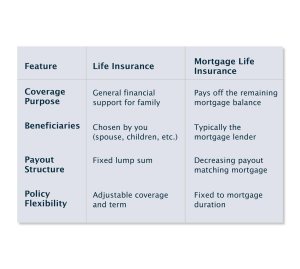

Key Differences Between Life Insurance and Mortgage Life Insurance

Coverage Purpose

-

Life Insurance: Provides general financial support for your family, covering expenses such as education, debts and daily living costs.

-

Mortgage Life Insurance: Specifically pays off the remaining mortgage balance, meaning that your home is protected.

Beneficiaries

-

Life Insurance: You choose who receives the payout (e.g., spouse, children or other dependents).

-

Mortgage Life Insurance: The payout usually goes directly to the mortgage lender, not your family.

Payout Structure

-

Life Insurance: Pays a fixed lump sum regardless of when you pass away during the policy term.

-

Mortgage Life Insurance: The payout decreases over time as your mortgage balance reduces.

Policy Flexibility

-

Life Insurance: Can be adjusted to suit your financial goals, allowing changes in coverage and term length.

-

Mortgage Life Insurance: Tied directly to your mortgage, with little flexibility.

Use of Funds

-

Life Insurance: Funds can be used for any purpose, such as funeral costs, childcare or other financial needs.

-

Mortgage Life Insurance: Funds are strictly used for paying off the mortgage.

Affordability

-

Life Insurance: Can be more expensive depending on coverage amount and policy type.

-

Mortgage Life Insurance: Typically more affordable, especially if taken out when young.

Pros and Cons of Life Insurance

Pros:

-

Provides financial security for your family.

-

Payout can be used for any purpose, including mortgage, education and daily expenses.

-

Fixed lump sum regardless of when you pass away during the policy term.

-

Choice of term or whole-life policies.

-

Can include critical illness coverage for added protection.

Cons:

-

Premiums can be higher than mortgage life insurance.

-

Requires health assessments in most cases.

-

Can be complex with many policy variations to choose from.

Pros and Cons of Mortgage Life Insurance

Pros:

-

Guarantees your mortgage is paid off if you pass away.

-

Easier to get approved for, often without a medical exam.

-

Typically cheaper than term life insurance (at least in the early years).

-

Provides peace of mind knowing your family won’t have to worry about mortgage payments.

Cons:

-

Coverage amount decreases over time but premiums stay the same.

-

Your family does not receive the payout – only the lender benefits.

-

Less flexibility in how the payout can be used.

-

Might not cover additional debts or living expenses.

Who Should Choose Life Insurance?

Life insurance is best suited for:

-

Families who want to provide financial support beyond just the mortgage.

-

Individuals with dependents who rely on their income.

-

People who want flexibility in how their insurance payout is used.

-

Those looking for coverage beyond their mortgage term.

-

Anyone wanting peace of mind knowing their family will be financially secure.

Who Should Choose Mortgage Life Insurance?

Mortgage life insurance might be right for:

-

Homeowners who primarily want to make sure that their mortgage is paid off.

-

People with limited budgets who want an affordable option.

-

Those who have difficulty qualifying for traditional life insurance due to health conditions.

-

Individuals looking for a simple, no-frills policy that focuses only on mortgage protection.

Can You Have Both Policies?

Yes – many homeowners choose to have both life insurance and mortgage life insurance. This way, the mortgage is covered, and additional financial support is available for their family. If budget allows, having both can provide full protection, meaning you can rest assured that your loved ones aren’t left with unexpected expenses.

Making the Right Choice for Your Needs

If you want broader financial protection for your family, a life insurance plan is the better choice. However, if your main concern is making sure your mortgage is paid off, then mortgage life insurance might be sufficient.

A hybrid approach can also work, you can take out both types of insurance for added security. Speak to an insurance professional to tailor a plan that suits your financial situation and goals.

It’s also important to periodically review your policy. If your mortgage decreases significantly or you take on new financial obligations, adjusting your insurance coverage ensures it remains relevant.

Get the Right Coverage Today

At Assura Protect, we help UK homeowners find the best insurance solutions for their needs. Whether you’re considering mortgage life insurance, term life insurance or a modern life insurance policy, our experts can guide you.

Want to find out more about our life insurance plans? Get a free quote today from our expert team.