As a single parent, you’re not just a caregiver; you’re the entire support system for your child. The responsibilities on your shoulders are immense, and safeguarding your child’s wellbeing, security and assets is likely a huge priority for you. As such, one of the most crucial steps you can take to protect your child’s future is securing life insurance.

However, with so many different kinds of policies and providers available, it can be hard to know which is right for your specific circumstances. If you’re in need of some guidance, this blog will explore why life insurance is essential for single parents, the various types available and how to choose the best policy for your needs.

Why Single Parents Need Life Insurance

Life insurance is a topic that people often like to avoid, but however morbid it might seem, it’s important to remember that it can be a lifeline for your family if they suddenly find themselves without your support.

Here are some of the biggest reasons that you should take out a life insurance policy as a single parent.

Financial Security for Your Children

In 2022, Direct Line reported that 32% of people who take out life insurance do so to ensure that their loved ones are provided with financial security when they’re not there anymore. As a single parent, your income might be the sole financial support for your household, meaning that if something were to happen to you, life insurance ensures that your child can continue to have a stable financial base. This can cover everything from everyday expenses to education costs and future savings.

Covering Debts & Expenses

Life insurance can also be used to cover outstanding debts and expenses that you might leave behind. Mortgages, car loans, credit card debts and personal loans have the potential to become overwhelming for your surviving family members. A life insurance policy can help to settle any financial obligations so that your child isn’t burdened with them.

Access to Education

Education is a huge expense that can ultimately shape your child’s future. With life insurance, you can make sure that your child can pursue higher education if they wish to, without the stress of financial constraints. It can help to cover tuition fees, maintenance loans, accommodation, course fees and other related costs.

Peace of Mind

Having life insurance can provide you with peace of mind, as you can be safe in the knowledge that your child will be taken care of financially if something happens to you. This assurance hopefully allows you to focus more on the present and enjoy the time you have with your children, without the constant worry about their future.

Types of Life Insurance Policies for Single Parents

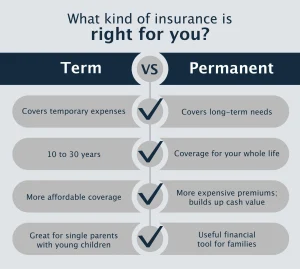

There are several different types of life insurance policy that make a practical choice for single parents.

Term Life Insurance

Term life insurance is a policy that lasts for a set amount of time – usually between 10-30 years. This makes it a particularly appealing choice for single parents, who can purchase a policy that lasts until their children are grown up and living independently.

If your child is currently an infant, for instance, a 20-year or 30-year policy might make the most sense. Alternatively, if you have teens, a policy that only lasts 10 years could be enough.

Because term life insurance is temporary, it’s typically more affordable than permanent life insurance. However, your term policy may also come with a conversion rider that allows you to switch to a permanent policy should you want or need to.

Within the term life insurance umbrella there are several different policies you can purchase:

-

Term life insurance: Maintains the same death benefit amount throughout the term of the policy.

-

Decreasing life term insurance: A low-cost option with a death benefit that decreases over time. Can be useful if you have specific outstanding financial obligations, such as a mortgage, that you don’t want your family to become financially responsible for.

-

Guaranteed renewable term insurance: This policy still has an expiration date, but there’s also an option of automatic renewal. However, renewal premiums do increase significantly depending on your age.

-

Return of premium insurance: If you outlive this type of term policy, you receive a refund of the premiums you paid. Although it’s more expensive than other types of term insurance, it might be worth it if you prefer a guaranteed payout.

Permanent Life Insurance

As the name suggests, permanent life insurance policies are designed to remain in effect for as long as you are alive, so long as you continue to pay the necessary premium.

Permanent policies can build up cash value over time which, in certain circumstances, can be borrowed against or withdrawn. Because it’s a lifelong policy, permanent life insurance is typically more expensive than term ones.

There are two main types of permanent life insurance:

-

Whole life insurance: A relatively simple type of policy which features fixed premiums that won’t change over time and will last your entire lifetime (maximum coverage ages often range from 95-120 years old). Whole life policies typically earn cash value at a set interest rate, and may also be eligible for dividends.

-

Universal life insurance: This policy provides a level of flexibility when it comes to your life insurance. You may be given the option to adjust your death benefit or premium amount, and you can also accumulate cash value – although the interest rate may vary depending on the market.

How to Get Started with Life Insurance Cover

Have you decided that purchasing life insurance is the right choice for you and your family? Here are some basic tips on what you need to do next.

Assess Your Finances

Start by taking a thorough look at your financial situation. List your income, expenses, debts and assets, and consider what financial support your child would need if you were no longer there to provide it. This kind of self-assessment will help you determine the amount of coverage you require.

Research & Compare Policies

Once you have a good understanding of your needs, start researching different life insurance policies. Use online tools and resources to compare options from various providers. Look for policies that offer the right balance of coverage, affordability and additional benefits to suit your specific circumstances.

Consult with an Insurance Provider

Speaking with a professional can provide you with valuable insights and help you to navigate the complexities of life insurance. They’ll be able to answer your questions, explain the differences between policies and assist you in finding the best coverage for your situation.

Make an Informed Decision

After gathering up all the necessary information and consulting with a provider, it’s time to make an informed decision about which life insurance policy to purchase. Always double check that the policy you choose aligns with your financial goals and provides adequate protection for your child’s future.

Modern, Innovative Life Insurance Policies

At Assura Protect, we understand the unique challenges single parents face, which is why our comprehensive range of life insurance policies are designed to provide you and your family with the financial security and peace of mind that you need.

Want to find out how much you could be expecting to pay for our life insurance policies? Fill out our online form to obtain a quick, no obligation quote. Or, if you’d like more information about our services, please get in touch with us.