In the uncertainty of today’s world, safeguarding yourself against unexpected health challenges is growing increasingly important. Finding the right insurance policy for your situation is crucial, and critical illness cover can be an excellent way to protect yourself in unexpected circumstances. Having insurance cover for unexpected health situations can give you the opportunity to focus on your recovery without any added financial stress. Our blog looks at critical illness insurance cover, and the options that you have if you are denied this type of insurance. To learn more about what a critical illness policy can offer you, keep on reading.

What You Need To Know About Critical Illness Policies & How They Work

Critical illness cover is a type of insurance cover that provides individuals with a lump sum of money, in the event that they are diagnosed with a specific illness or disability. Critical illness cover typically covers chronic and long-term serious illnesses, which may vary depending on your insurance provider. Taking out critical illness cover can be useful for a variety of groups, ranging from families to individuals. Critical illness cover can provide peace of mind as well as financial security for individuals, families and loved ones.

How Does Critical Illness Cover Work?

For anybody considering critical illness cover as their choice of health insurance, it’s important to understand how this type of cover works before making any decisions. Read below to understand in clear, simple steps, how a typical critical illness insurance claim would work.

-

Research & Understanding Policy Terms – It’s crucial to understand the policy terms and illnesses covered by your insurance. Doing thorough research into all of your options is recommended, leading you to the most informed decision regarding your life insurance policies.

-

Purchase Policy – Once you have decided that critical illness cover is the policy you would like to choose, you would then purchase this policy from your chosen insurer.

-

Diagnosis – If you have been diagnosed with an illness or disability that is in line with the terms of your insurance, you will be able to make a claim. Getting diagnosed and having the relevant documents from your doctor is essential for ensuring the success of your claim. Ensure you have legitimate documents from a medical professional, and contact your insurer as soon as possible following your diagnosis.

-

Making A Claim – Once you have your documents, you can make your claim with your insurer. They will review the claim, and ensure it is in line with the terms of your policy, checking which illnesses are/are not covered, as well as your medical records.

-

Payout – In the event that your claim is successful, your insurer will have verified your documents and checked your medical records, seeing that you are eligible for your claim. You will then receive your payout money, and complete any final paperwork.

-

Insurance Policy Ends – With most traditional critical illness cover policies, the policy term will end after you receive your insurance payout.

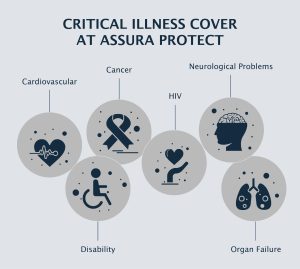

Critical Illness Cover With Assura Protect

At Assura Protect, our critical illness cover works a little differently. The cover provided by standard critical illness policies often ends after the lump sum is paid out, which can pose potential problems for those with ongoing or life-long health concerns. Our 200% multi-claim critical illness cover is designed to provide better cover, for longer.

Multi-Claim Critical Illness Cover

At Assura Protect, we offer multi-claim critical illness cover, which provides extensive protection against critical illness and life events. Unlike traditional critical illness cover, our policies allow multiple claims for different illnesses and events. Our multi-claim critical illness cover allows:

-

Multiple Claims

-

Flexibility On A Range Of Health Conditions

-

Enhanced Peace Of Mind

-

Tailored Support To Meet Your Individual Needs

-

Comprehensive Financial Protection

-

Eligible For A Death Benefit

Modern life requires modern insurance solutions that can offer better chances of surviving serious illnesses, alongside financial security. Multi-claim critical illness cover can help you avoid complexities with your insurance policies and ongoing health conditions.

What Happens If I Am Denied Critical Illness Cover?

There is a chance that your critical illness cover may be rejected and there are a multitude of factors that can influence this. If you’re concerned about having your insurance claim denied, read below to understand how to enhance your chances of making a successful claim, and what your options are if you are denied this type of insurance cover.

Why Might Critical Illness Cover Be Denied?

Some of the main reasons why your critical illness cover could be denied include:

-

Misrepresentation & Non-Disclosure – When applying for any type of life insurance plan, including critical illness cover, it’s essential that you disclose your full medical history and any pre-existing conditions or lifestyle habits that may impact your coverage. Failure to disclose the relevant information could delay your claims process and even result in a failed application.

-

Policy Exclusions – When researching your options, you will find that different insurers and critical illness policies will list the specific conditions and illnesses that they cover. If your diagnosis is not included in your policy, then your claim may be denied. You should always research your policy thoroughly, and read the terms carefully to avoid these issues.

-

Policy Definitions – In relation to the last point, if your diagnosed illness doesn’t meet the criteria outlined in your policy, such as the severity of the illness, then this may also result in a rejected claim.

-

Fraudulent Claims – It goes without saying that fraudulent claims, fabricating medical evidence or misrepresenting the severity of your claim will also result in a rejection.

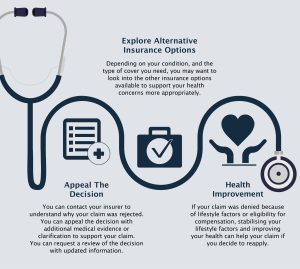

What Are My Options If My Critical Illness Cover Is Denied?

If your critical illness cover has been denied, you may be stressed about what your options are. Read below to understand some of the best options available for a denied claim.

Finding The Right Life Insurance Plan: Assura Protect

Critical illness cover can play a vital role in preparing you for life’s uncertainties, giving you the financial security and peace of mind you need during challenging times. At Assura Protect, we understand the importance of comprehensive life insurance that can adapt to your needs, whether it’s easing financial burdens, or giving you peace of mind when you need it most. We encourage you to explore your options carefully so that you can find the right life insurance cover for your future.

To learn more about our critical illness cover policies, or any of our other life insurance options, feel free to get in touch with our team for more information.