Dividend Life

Term Life & Multi-Claim Critical Illness Cover

Modern Life Insurance with:

200% Multi-Claim Critical Illness Cover

200% Dual Life Cover

Doctor-on-Demand with 24/7 GP Services

Life Empowered Membership Benefits

We are Life Empowered

We are Life Empowered

3 Policy Holder Dividends

Multi-Claim Cover

200% Critical Illness Cover

Up to 3 Critical Illness claims per policy.

Total Maximum Benefit of up to 200% of Sum Assured.

200% Dual Life Cover.

Modern alternative to traditional joint life protection covering both lives not just first.

Membership Benefits

Annabel Rewards with 300 Retail Partners included.

Additional benefits included: a dedicated concierge service and direct access to leading global periodicals.

Doctor-on-Demand

24/7 UK-based virtual GP consultations available.

Face-to-face consultations at a time that suits from anywhere in the world.

Prescriptions sent direct to chosen pharmacy for collection/delivery.

Policy Dividends are included on all policies. Without additional premium charges, fees or costs.

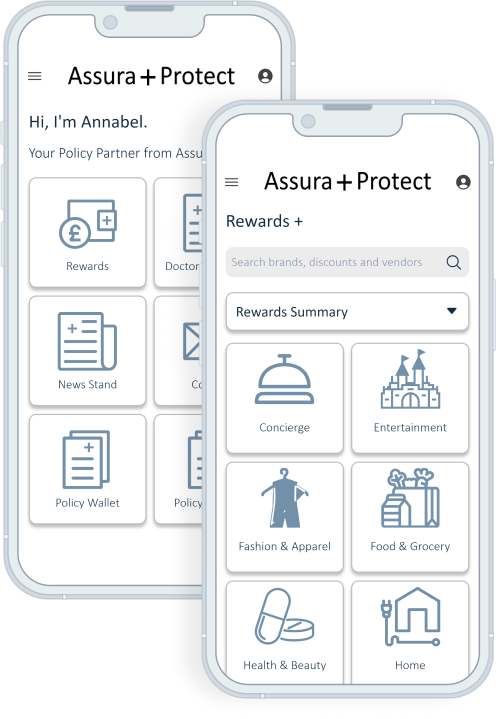

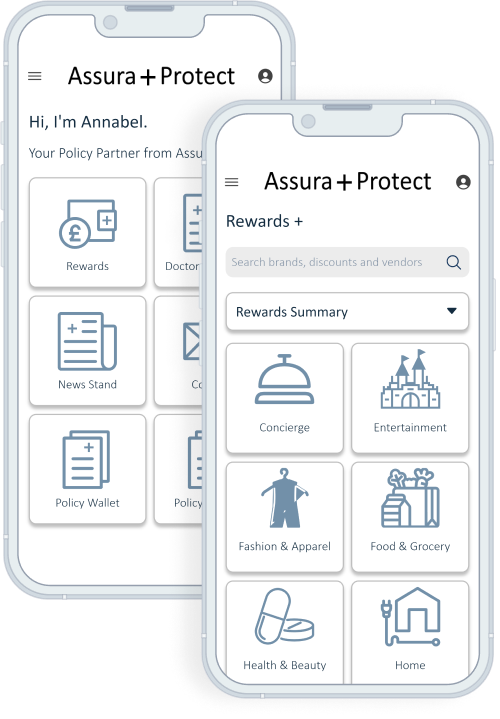

Powered by Annabel ….

Your digital insurance partner.

Features:

Annabel Rewards & Concierge

Doctor-on-Demand

Newsstand

Functions:

Robo Advisor

Policy & Trust Wallet

Dividend Life Compared

Protection value created through …

Cover features, policy benefits and competitive premiums.

How does Dividend Life Cover, Benefits & Premiums compare to national U.K. life insurers.

For more information please click the “arrow icon” for more information.

| Term Life | Assura + Protect | National Life Insurer 11 | National Life Insurer 21 | National Life Insurer 31 |

|---|---|---|---|---|

| Policyholder Benefits | Comprehensive | None | None | Limited |

| Extended Health Cover | Comprehensive | Limited | Limited | Basic |

| Partner Cover | Yes | Yes | Yes | Yes |

| Monthly Premiums2 |

For more information please click the “arrow icon” for more information.

| Term Life with Critical Illness | Assura + Protect | National Life Insurer 11 | National Life Insurer 21 | National Life Insurer 31 |

|---|---|---|---|---|

| Cover Type | Life and Critical Illness | Life or Critical Illness | Life or Critical Illness | Critical Illness Only |

| Conditions Covered4 | 42 | 37 | 40 | 41 |

| Monthly Premiums5 |

Notes:

- Representative National Life Insurers are selected from top 5 UK Life Insurers by annual policy sales.

- Indicative policy pricing for 35 year old / £200,000 Sum Assured / 20 Year Term with no medical loadings derived from publicly available company websites and price comparison websites on May 26, 2023.

- Indicative policy pricing for 35 years old / £350,000 Sum Assured / 20 Year Term with no medical loadings derived from publicly available company websites and price comparison websites on May 26, 2023.

- Core conditions covered and included as in standard and/or base premiums.

- Indicative policy pricing for 35 year old / £100,000 Sum Assured / 20 Year Term with no medical loadings derived from publicly available company websites and price comparison websites on May 26, 2023.