Renewing or Converting Your Term Life Policy: What You Need to Know

When you first took out your term life insurance, you likely considered it a safeguard against the unexpected. Fast forward several years, and your circumstances may have changed, for example, you might have a larger family, a bigger mortgage or different financial goals. This means that now, you’re left with a big decision: should you renew or convert your term life policy? This guide will walk you through everything you need to know about renewing or converting your term life insurance, helping you make an informed choice that helps you and your loved ones stay protected.

What Is a Term Life Policy?

A term life policy provides life insurance cover for a set period – usually 10, 20 or 30 years. If you pass away during the policy term, your beneficiaries receive a payout. Unlike whole life insurance, a term policy does not build cash value. It’s straightforward, affordable, and ideal for individuals or families seeking financial protection during key life stages, such as raising children or paying off a mortgage.

Many people choose a level term assurance policy, which means that the payout amount remains fixed throughout the term. This predictable coverage can provide peace of mind, knowing your loved ones are covered, no matter when an unexpected event might occur.

Why Consider Renewing Your Term Life Insurance?

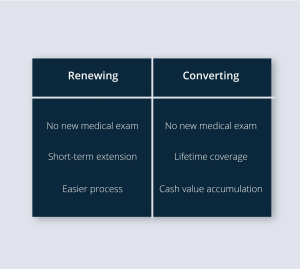

When your original policy is nearing its end, you have the option to renew it. Renewing essentially means extending your existing term life insurance for another period without undergoing another medical exam. This option can be beneficial for several reasons:

-

Health Concerns: If your health has deteriorated since you first took out the policy, renewing may be a smart move. By avoiding a new medical exam, you can lock in coverage without the risk of being declined or paying sky-high premiums.

-

Short-Term Needs: Perhaps you only need life insurance for a few more years, for example, until your children are financially independent. Renewing for a shorter term can be a convenient option.

-

Simplicity: Renewing a policy is typically quicker and easier than shopping for a new term assurance quote, saving you time and hassle.

However, keep in mind that renewing an existing policy often comes with higher premiums since you’ll be older at the time of renewal. It’s important to compare the cost of renewal with other available options.

What Does Converting Your Term Life Policy Mean?

Conversion involves changing your term life insurance into a permanent life insurance policy, such as whole life or universal life insurance. This option allows you to maintain coverage indefinitely, meaning that your beneficiaries will receive a payout regardless of when you pass away.

Some of the biggest benefits of converting include:

-

Lifetime Coverage: Unlike a term policy that eventually expires, a converted policy provides life insurance cover for your entire life.

-

No Medical Exam Required: Similar to renewal, conversion doesn’t require you to undergo another medical exam. This can be a crucial benefit if your health has changed since you first applied for coverage.

-

Cash Value Component: Permanent policies build cash value over time, which you can borrow against or even withdraw for various financial needs.

That said, conversion typically results in significantly higher premiums than a term life policy. Before making the switch, take stock of your financial situation and long-term goals to check that it’s the right move for you.

Factors to Consider When Renewing or Converting

Whether you’re leaning toward renewing or converting your term life insurance, there are several important factors to keep in mind:

-

Current Health Status: If your health has improved since you initially took out your policy, you might qualify for better rates by shopping around for a new term assurance quote.

-

Family Needs: Think about how your family’s financial needs have changed. Do you still have dependents who rely on your income, or has your mortgage been paid off?

-

Budget: While conversion offers lifetime coverage, it’s also more expensive. Be sure to review your budget and see if the higher premiums fit into your financial plan.

-

Policy Terms: Not all term life insurance policies are convertible. Check with your provider to see if your policy includes a conversion option and whether there are any deadlines for making the switch.

When Should You Switch to a New Policy?

In some cases, it might make sense to forgo renewal or conversion altogether and instead take out a brand-new policy. Here are a few scenarios where switching to a new term life policy could be the right option:

-

You’re in better health: Improved health or lifestyle changes may qualify you for lower premiums with a new policy.

-

You need more coverage: If your financial responsibilities have grown, such as having additional children or purchasing a larger home, a new policy with a higher payout might be necessary.

-

You want a longer term: Renewing an existing policy may only offer short-term extensions. If you need long-term coverage, a new policy might be more suitable.

How to Get the Best Term Assurance Quote

If you decide to shop around for a new policy, there are a few things you can do to get the best term assurance quote:

-

Compare Multiple Providers: Don’t settle for the first quote you receive. Compare options from various insurers to find the best value.

-

Choose the Right Term Length: Assess how long you’ll need coverage. Common terms include 10, 20 and 30 years, but the ideal length depends on your specific needs.

-

Consider Level Term Assurance: Level term assurance ensures a fixed payout amount throughout the policy term, offering consistent financial protection.

-

Work with a Broker: A broker can help you navigate the options and find the most competitive rates based on your circumstances.

Making the Right Decision

Deciding whether to renew, convert or switch your term life policy is a big financial choice that requires careful consideration. Assess your current needs, budget and future goals before making a decision. Remember: life insurance cover is about providing peace of mind and financial security for your loved ones, so making the right decision is essential.

If you’re unsure about your options, why not reach out to Assura Protect for expert guidance? Our friendly team can help you explore the best options tailored to your unique needs and budget.

Whether you’re renewing, converting or starting fresh with a new policy, Assura Protect is here to help. Get a personalised term assurance quote today and secure the life insurance cover that’s right for you