Life cover is a type of insurance policy that covers an individual in the event that they pass away, offering financial security to their family when they’re gone. A lump sum will be paid out, which can then be used to cover a range of costs, such as mortgage repayments, funeral costs and any other expenses during what can be a difficult time for your loved ones.

There are different types of life cover available, most notably single cover and dual cover. We’ll explore each of these options further in this blog, discussing how they differ and when each may be suitable for different circumstances based on their individual benefits and disadvantages, along with a look at the cover we offer here at Assura Protect.

Read on to learn all you need to know about life cover.

Understanding the Difference Between Life Assurance and Life Insurance

Before we go into detail on the different types of cover available, let us first quickly define the difference between life insurance and life assurance.

Life insurance refers to an insurance policy that makes a tax-free lump sum benefit payment in the event of your death. However, these policies only cover you for a specific term, so your beneficiary(ies) will only receive a benefit payment if you do within the policy term. These are also known as term life insurance.

In comparison, life assurance also makes a tax-free lump sum benefit payment in the event of your death, however the key difference is that it covers you for the full duration of your life. This means that a payment is guaranteed, although it does mean premiums tend to be higher for life assurance policies compared to life insurance ones. Life assurance is also known as whole life insurance.

For the purposes of this article, we’ll be discussing different types of life insurance policies (aka term life insurance).

Single vs Dual Life Cover: What’s the Difference?

Single Cover

A single cover life insurance policy covers an individual person. In the event that this person dies (during the length of the policy), then the chosen amount of cover will be paid out to whomever is listed as a beneficiary.

There can be a single beneficiary or multiple beneficiaries, depending on the policy-holder’s wishes. Beneficiaries can be anyone (e.g. partner, child, family member, friend or charity) and they may each receive different amounts if chosen by the policyholder. For example, you may leave 50% to a partner, 20% to each of your children and 10% to a close friend or a charity.

If two partners in a couple each have their own single cover life policy, then in the event that one partner dies, the other is still covered by their own policy.

Dual Cover

In comparison, dual cover is a singular life insurance policy that covers two people; it’s most often taken out by partners, however any two people can take out a dual cover policy together, you don’t have to be a couple.

With dual cover, each partner is insured separately, despite being under one policy. This means that, in the event that one partner dies, protection remains in place for the surviving partner. Whilst the surviving partner will automatically receive the payment following the other partner’s death as the remaining legal owner of the policy, you can nominate separate beneficiaries nominated for each benefit payment if the policy is placed into a trust.

How is this different from Joint Cover?

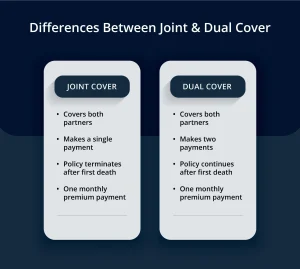

It’s important to note that dual cover is different to joint cover, which is another option that many couples opt to take out.

Whilst joint cover also covers both partners, the policy terminates when one partner passes away, meaning a benefit payment is paid only for a single death. This means the surviving partner will not be covered by the policy when they then pass away and will need to take out a new single cover policy if they wish to be covered.

When May Each Be Best?

So, between single, joint and dual life cover, which may be best for you and your partner?

No one policy type is better than the other, as which could be most beneficial to you can depend on various circumstances.

Let’s take a look at the benefits and disadvantages of each.

Single

Benefits

-

Each partner can set different levels of cover depending on what is most suitable for them as an individual.

-

The surviving partner is still covered in the event that the other partner dies.

-

Two lump sums are paid, not just one.

-

They are particularly suitable to younger couples who may have children to support and mortgages to pay off.

-

You can choose your beneficiaries.

Disadvantages

-

Tends to be more expensive having to cover two separate premium payments.

-

Separate applications need to be made.

-

Premiums tend to be higher with single policies compared to joint policies.

Joint

Benefits

-

Often more affordable than having two separate policies, as only one regular payment needs to be made.

-

Can be easier to manage for couples with joint finances.

-

A lump sum may be paid faster in the event of one policyholder dying, since it’s clear who’s nominated to receive the money after a death.

-

Premiums tend to be lower than those in single policies.

-

Anyone can take out a joint policy – you don’t have to be in a relationship.

Disadvantages

-

The policy terminates when the first person dies, leaving the surviving person without cover.

-

The payout will only go to the person named on the policy, you cannot include any named beneficiaries.

-

Only one lump sum is made, rather than two separate lump sums.

-

You must have cover for the same amount, which isn’t always suitable depending on individual needs.

Dual

Benefits

-

Insures both people on the policy, meaning if one person dies the remaining policyholder is still covered.

-

Two lump sums will be paid, not just one.

-

Separate beneficiaries can be nominated for each benefit payment if the policy is placed in a trust

-

Often has similar premiums to joint policies, so can be lower than premiums for single policies.

-

Often more affordable than having two separate policies.

-

Can be easier to manage for couples with joint finances.

Disadvantages

-

If you do place the policy in a trust in order to name separate beneficiaries, then you may not be able to as easily make any amendments if required (for example, this may require the permission of the trustees, you may incur tax implications and the policy may become invalidated)

-

If you do place the policy in a trust, then this cannot be removed.

-

May not be as suitable for partners who require different levels of cover.

Term Life Insurance Quotes from Assura Protect

Here at Assura Protect, we’re proud to offer Dual Life cover designed to offer the comprehensive protection you and your partner require.

Whilst many other leading national life insurance providers offer partner cover with limited extended health cover and either no or limited policyholder benefits, when you take out an insurance policy with us you can rest assured that you will be receiving partner cover with both comprehensive extended health cover and policyholder benefits.

We also offer life and critical illness cover, where other insurers may only offer life or critical illness cover.

Get Your Quick, Free Quote Today

Could dual life cover be a good option for you? If you’d like to take out a policy with us, then take advantage of our quick quote service. Simply let us know some of your details and answer a few quick questions regarding your health and the type of cover you’re looking for, then we’ll email you with your free, no obligation quote!

Need assistance? Whether you’d like to learn more about the cover we offer, the benefits we offer our members or would like to retrieve your quote over the phone, then get in touch with us today and we’ll be happy to assist you.