Life is a combination of shared moments and intertwined destinies. In today’s unpredictable world, ensuring financial security for yourself and your loved ones has never been more important. As couples embark on their shared journey, they seek not only to protect their individual futures, but to also safeguard the wellbeing of their partner. This extends beyond the mundane into the realm of financial planning and protection. In a world where financial security matters more than ever, couples seek life insurance solutions that provide comprehensive coverage. While traditional life insurance policies offer valuable protection, there is a growing recognition of the need for more comprehensive coverage that extends far beyond the basics. Part of award-winning Dividend Life, Dual Life is a solution offered by Assura + Protect, designed to provide double the protection for couples and partners.

In this blog, we review Dual Life Cover from Assura + Protect, a modern alternative to traditional joint life cover that ensures both partners receive the utmost care. Part of Dividend Life, we explore its features, benefits and how it protects both partners compared to traditional Joint Life Cover. Whether you are newlyweds building dreams or seasoned companions navigating life’s twists and turns, explore Dual Life cover and the legacy it creates.

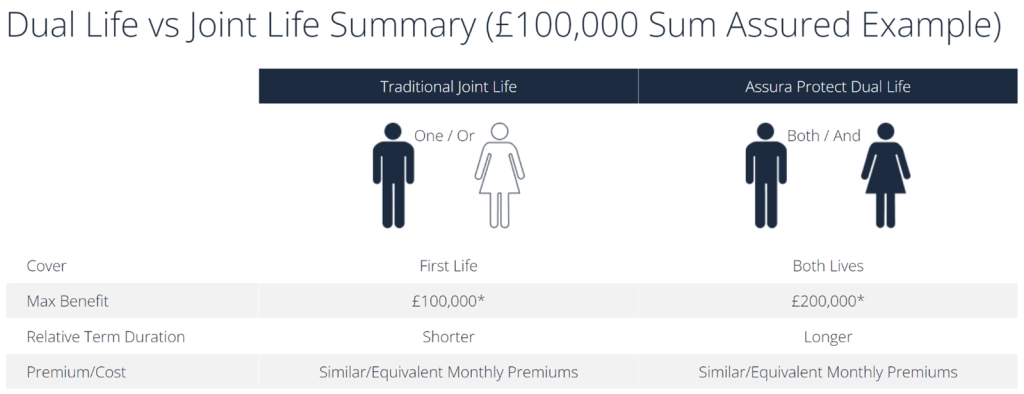

Traditional Joint Life vs. Assura Dual Life Cover

Traditional Joint Life policies are like a cozy two-seater bike – both partners ride together, but if one falls off, the ride ends. In partnerships, where household income, expenses, and mortgages are managed collectively, couples often see the benefits of shared financial planning. Until now, couples have regularly opted for traditional Joint Life cover to protect both partners and provide shared financial security. Joint Life cover pays out a lump sum when the first person dies within the policy term.

Traditional Joint Life Cover, however, has some additional protection considerations though:

- The policy terminates when one partner passes away.

- It provides a single death benefit payment only leaving the surviving partner without any cover.

- If both partners die simultaneously, or the second partner passes away soon after the first, there will be no additional benefit payment.

- Policy premiums are relatively expensive versus the cover provided.

- The policy cost may outweigh the benefits received.

Introducing Dividend Life with Dual Life cover from Assura + Protect. Watch the video to discover more.

Dividend Life with 200% Multi-Claim Critical Illness & Dual Life Cover Video

Part of Dividend Life, Dual Life cover is a modern solution that offers double the level of protection to partners and couples. It covers both partners separately and pays out a benefit on the death of each policyholder.

Dual Life cover is more than just part of your Dividend Life insurance plan. It’s the understanding that life’s uncertainties can affect not just one, but both partners. Unlike traditional joint life insurance which covers only the policyholder, Dual Life provides up to 200% cover for couples and partners, double the amount of cover of traditional joint life policies. This means greater financial support for your loved ones. Dividend Life policyholders get more effective cover for their premium payments.

Dual Life cover from Assura + Protect stands out due to its innovative features and advantages over Joint Life cover.

Dual Life cover:

- Insures each partner separately.

- Unlike Joint Life policies, where coverage is shared, Dual Life provides individual protection for both partners. Each partner has their own policy, ensuring coverage is tailored to their unique individual needs and circumstances.

In summary, Dual Life insurance offers greater flexibility, enhanced benefits, and tailored coverage for couples and partners, making it a compelling choice for those seeking comprehensive protection.

How does Dual Life Cover work?

Dual Life cover provides coverage for both partners simultaneously. In the event of a tragedy, the surviving partner receives the benefit, offering financial stability during a challenging time.

Dual Life cover insures each partner separately, and will pay a benefit on both deaths, not just the first. If one partner dies before the other, protection remains in place for the surviving partner. With twice as much effective cover and sum assured, Dual Life provides greater value for premium to policyholders. Dual Life offers a streamlined approach, simplifying the process and often resulting in cost savings.

Unlike Joint Life policies, where coverage is shared, Dual Life provides individual protection for both partners. Dual Life is available on all Assura + Protect Term Life and Multi-Claim Critical Illness policies.

What are the benefits of Dual Life Cover?

Peace of Mind

Knowing that you and your partner are equally protected, bringing peace of mind. With each partner having their own policy, it’s like having two safety nets. Dual Life coverage ensures that neither of you faces financial hardship alone.

Double the Benefit

Dual Life Cover pays out twice the sum assured compared to traditional joint life cover. The increased benefit provides greater value for premium.

Estate Planning

Dual Life allows you to nominate separate beneficiaries for each benefit payment when placing the policy in trust. making estate planning and inheritance planning easier.

Legacy Preservation

Dual Life cover preserves your shared dreams, aspirations, and financial security.

Flexible Beneficiary Nominations

With Dual Life cover, separate beneficiaries can be nominated for each benefit payment. This simplifies estate planning and ensures clarity is maintained.

Dual Life Cover Case Study 1

James and Chloe have just bought the house of their dreams. They also purchased £200,000 term life insurance to provide piece of mind and financial security for their accompanying mortgage. Instead of purchasing a traditional Joint Life policy, which would make only one benefit payment on the passing of either James and Chloe and then terminate their policy, they purchased an Assura + Protect Dual Life policy with a sum assured of £200,000. Should the worse happen, a £200,000 benefit would be paid on both James and Chloe’ s lives, not just on the first life.

Dual Life Cover Case Study 2

Sarah and Mark, a married couple in their early 40s, were keen on securing their family’s financial future. They both understood the importance of life insurance but wanted a solution that went beyond traditional options. That’s when they discovered Dual Life insurance from Assura + Protect.

Compared to traditional Joint Life cover, Assura + Protect’s Dual Life cover offers significant advantages:

- A £200,000 benefit would be paid on both James’ life and Chloe’s life, not just the first life as with a traditional Joint Life policy. The total maximum benefit would be £400,000, equating to twice as much cover.

- Longer insurability with total cover lasting over both lives, not just one.

- As effectively two separate policies, protection can be more easily partitioned if circumstances warranted. Additionally, separate beneficiaries can be nominated for each benefit payment, simplifying estate planning.

- Best of all, Assura + Protect’s Dual Life cover has similar monthly premiums to traditional Joint Life policies.

Sarah’s Diagnosis

A few years into their Dividend Life policy with Dual Life Cover and Sarah was diagnosed with a critical illness that was covered by the policy. The stress of medical bills and uncertainty weighed heavily on the family.

Being a Dividend Life with Dual Life cover policyholder allowed Sarah to make a critical illness claim with her receiving 75% of the sum assured. This substantial benefit eased their financial burden during a challenging time.

Mark knew that even if the worst happened, Sarah’s protection would remain intact. Dividend Life with Dual Life cover gave him peace of mind, knowing that the family financial continuity was assured.

Sarah and Mark’s experience exemplifies the power of Dual Life cover. It’s not just about the numbers, it’s about commitment to each other and their family’s wellbeing. Assura + Protect’s Dividend Life with Dual Life cover ensure that love and security extend beyond the first chapter.

Why Choose Assura + Protect?

When it comes to selecting a Dual Life policy, choosing the right provider is essential. Assura + Protect stands out as a trusted and reputable insurer, known for its commitment to customer satisfaction and financial stability. Assura + Protect makes it easy for couples to secure the comprehensive coverage they need to protect their family.

Furthermore, Dual Life policies from Assura + Protect are backed by industry-leading expertise and service. From the initial application process to ongoing policy management, there is a team of experts dedicated to helping couples navigate the complexities of insurance and make informed decisions about their coverage.

Assura + Protect is focused on providing great protection products and service directly to customers.

Assura + Protect provides an innovative approach and is committed to offering a modern and comprehensive life insurance coverage solution. By simplifying customer engagement, Assura + Protect is better able to deliver:

+ Greater cost and premium savings

+ Increased Customer Service Levels

Assura Protect’s does this via its integrated technology platform including:

+ Automated Underwriting

+ Smart-Tech Customer Service

+ An Integrated Policy Wallet & App

+ Automated Claims Tracking & Notification

Navigating the application process

Applying for Dividend Life with Dual Life insurance from Assura + Protect is a straightforward process designed to provide peace of mind and security for couples. To get started, couples can Request an online quote.

During the application process, couples need to provide basic personal information about themselves, including their age, health history, and financial status. This information helps with the assessment of risk for applicants and helps determine the appropriate coverage and premium amounts.

Once submitted, your information will be reviewed and, if successful, your Dividend Life policy will be underwritten accordingly. In some cases, additional medical information or underwriting may be required to finalise the policy terms. Despite this, Assura + Protect strives to make the process as efficient and hassle-free as possible, ensuring that couples can secure the coverage they need within 24 hours of submitting their application.

The importance of regular reviews

After obtaining Dividend Life with Dual Life coverage, it is essential for couples and partners to regularly review and update their policy to ensure that it continues to meet their evolving needs. Life changes such as marriage, the birth of a child, or changes in financial status may warrant adjustments to the coverage amount or policy terms.

By staying proactive and regularly reviewing their policy, couples can ensure that they have adequate coverage in place to protect their family’s financial future. Additionally, regular reviews provide an opportunity to explore new features or riders that may enhance the policy’s value and provide additional peace of mind.

Concluding, Assura + Protect combines robust coverage, innovative features, and personalised services to provide a well-rounded life insurance experience. When you consider purchasing Dividend Life insurance with Dual Life cover, you are embarking on a journey that prioritises both financial security and commitment to your loved ones. Dividend Life with Dual Life Cover isn’t a transaction, it’s a legacy. It’s a story you write for generations to come, a story of resilience, love and unwavering commitment. Dual Life Cover provides enhanced protection, flexibility, and peace of mind for couples. It’s a smart choice for those who want to ensure financial security for both partners, even after one passes away. Take the next step. Explore the details of Dividend Life with Dual Life Cover and secure your financial future.