When it comes to critical illness cover, many insurance policies from leading providers don’t offer coverage that is in line with modern advancements in medicine and healthcare. Here at Assura Protect, however, we can see that this coverage is inadequate for modern needs, which is why we offer multi-claim critical illness cover.

In this guide, we’ll explore what this entails, offering insight into the benefits this coverage provides and why you should consider this type of coverage over alternative solutions offered by other leading insurers.

Keep reading to learn more.

What is Critical Illness Insurance?

Critical illness insurance is a type of insurance policy that covers you in the event that you are diagnosed with an illness defined (by your insurer) as ‘critical’. Should this happen during the policy term, then you will receive a lump-sum payout, which can be used to help cover the costs incurred as a result of your diagnosis – especially if it leaves you unable to work.

Such costs may include:

-

Paying off your mortgage

-

Your existing outgoings

-

Medical expenses

As for the types of illnesses that critical illness insurance covers, these will be defined in your specific policy, but typically include a variety of long-term and highly serious conditions that can have a severe impact on your health – for example, cancer, Parkinson’s disease or an illness that leaves you with a permanent disability.

It’s important to note that, when taking out critical insurance cover, there are various factors that may impact how much it will cost you.

The three key factors that an insurer will need to consider when determining how much your premiums will be are:

-

Your age – younger individuals tend to be a lesser risk to insurers, thus will often benefit from cheaper premiums

-

Your medical history – this is used to determine how much of a risk you may be for insurers having to make a payout

-

Your family’s medical history – if there is a long-running history of a particular illness in your family, then this may put you at higher risk, thus resulting in increased premiums

They’ll also take into account aspects such as your occupation and lifestyle. For example, a roofer who also smokes is likely to have higher premiums than an office worker who is a non-smoker.

It’s also vital that you make your insurer aware of any previous or pre-existing medical conditions that you have been/are being treated for; whilst it can be tempting to leave out such information in hopes of reducing your premiums, this can backfire on you in the event that you do need to make a claim, leaving you with no payout at all.

The Level of Cover We Offer

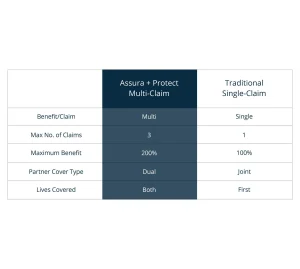

Many traditional critical life insurance policies offer single coverage. Here at Assura Protect, however, we recognise that this simply isn’t enough for many people, which is why we offer multi-claim coverage.

With modern advancements in medicine and healthcare, life expectancies are longer compared to decades ago and there is an increased likelihood of surviving serious illnesses. As such, single cover policies can leave you without protection after an initial claim, when protection is still required.

So, how does our multi-coverage policy work?

Three Major Conditions covered per policy

At Assura Protect, our multi-claim critical insurance cover offers you a maximum of three Major Conditions claims on your policy. A total of 42 conditions are covered within our Major Conditions, which are grouped into the following five categories:

-

Cancer & HIV

-

Cardiovascular

-

Organ Failure

-

Neurological

-

Disability

You can then make a maximum of one claim for each of the chosen Major Condition categories in your policy.

For example, if you choose to include Cancer & HIV, Neurological and Organ Failure on your policy and you’re diagnosed with cancer, then you can make a claim for this under the Cancer & HIV category on your policy. If you’re later re-diagnosed with cancer, then you cannot make a second claim for this. However, if you suffer from a stroke or a heart attack, then you can make a claim, as these are covered respectively under the Neurological and Organ Failure categories on your policy.

200% of initial sum maximum benefit

Unlike traditional critical illness cover policies, as offered by other insurers, that offer a maximum benefit of up to 100% of the initial sum assured for Major Condition claims, we at Assura Protect offer a maximum benefit of up to 200% for up to three unrelated claims.

We will pay a fixed benefit as follows for each successful claim that you make:

-

75% of your sum assured at the Claimable Event date on your first claim

-

75% of your sum assured at the Claimable Event date on your second claim

-

50% of your sum assured at the Claimable Event date on your third claim

In order to benefit from this, all claims you make must be for ‘unrelated’ conditions and cannot be claimed under the same Major Conditions category.

Life cover continues after initial claim

When it comes to traditional policies, many insurers offer critical illness or life cover, meaning your life cover ends should you make a critical illness claim. This doesn’t match with our primary goal here at Assura Protect – to provide ‘Better Cover… Longer’.

That’s why we offer critical illness and life cover. This means that your life cover will remain in place, even after making a critical illness claim.

We also offer dual life cover as an additional, optional inclusion on your policy. Unlike joint life cover insurance policies, this covers both yours and your partner’s life. This means that should one person die before the other, protection for the survivor remains in place. You can also nominate your own separate beneficiaries, ensuring your loved ones stay protected in the event of your passing.

Why Assura Protect?

As you can see already, there are numerous benefits our policies offer over traditional critical illness cover policies, including our multi-claim coverage and dual life coverage solutions.

However, the benefits we offer don’t stop there. When you take out a policy with Assura Protect, you get to reap the rewards of our membership benefits. After taking out a policy with us, you can download the Annabel app to confirm and store your Dividend Life documents, after which you can activate Annabel rewards to unlock various benefits, including:

-

300 Retail Rewards Partners across Grocery, Tech, Travel and much more

-

Annabel Concierge service

-

Doctor-on-Demand service – access digital GP services from anywhere in the world

Whether you’ve recently become a parent or have taken out your first mortgage, if you would like to benefit from comprehensive multi-claim critical illness and life insurance services, then get in touch with us today.

We’re dedicated to providing you with insurance policies that you can rely on.