As you move through life, there are various protections you can put in place to ensure that your loved ones are protected.

More specifically, if you have dependents or you’re financially responsible for a number of monthly payments, it is a good idea to have a plan in place in case something happens to you unexpectedly. This may mean writing an up to date will, choosing who will inherit your business, or taking out a life insurance policy.

Life insurance can ensure that the lifestyle of those you support can be maintained in the event of your death, where you will pay monthly premiums in return for payout at the end of your life. Importantly though, your insurance premiums and the details of your contract can vary according to your health, as various wellbeing factors can indicate how long you may live.

Read on to find out more about how various health factors can impact your life insurance quote, with a look at some of the details your insurer will assess and how you can improve your wellbeing for the better.

How Your Health Can Impact Your Life Insurance Policy

When you apply for a new life insurance policy, your final quote will be impacted by your current health and fitness level. Your insurer will need to conduct a medical examination or a review of your health records before you receive a quote, so that they can assess how your longevity may be impacted.

When it comes to assessing your health for life insurance, the key issue is that of risk. If you have a range of health issues or you’re over a certain age, then you are more likely to reach the end of your life before you’ve paid a certain amount of monthly payments. This means that your insurer is more likely to have to make a big payout at their own expense.

As such, if you’re in poor health, then you may receive a higher quote for your monthly premiums in order to secure the kind of payout that you need. This will be because your insurer has judged your risk level to be notably higher than average, meaning you need to pay more per month to qualify for a substantial death payment.

Key Health & Lifestyle Factors To Consider

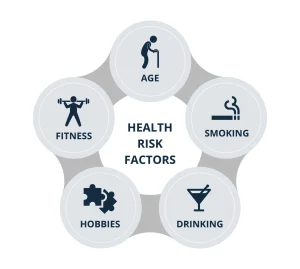

There are a range of health and lifestyle factors that can impact your insurance premiums, where the criteria taken into account will vary depending on the policy you’ve chosen.

In general, some key risk factors that insurers tend to consider include:

Age

One of the main risk factors when it comes to your insurance premiums will be your age. The older you are, the less likely it is that you will be able to pay your premiums for an extended period. As a result, some insurers will only allow you to take out a policy if you’re below a certain age.

Because of this, it is recommended to take out a life insurance policy as early as possible, in order to ensure that your new policy is affordable.

Weight & Fitness Level

Your insurance company will also consider your weight and your general fitness level when they are assessing your policy costs. Usually this is because being over or under the recommended weight for your build can increase the risk of developing various health conditions, some of which can shorten your life expectancy.

Making sure that you lead a healthy, active lifestyle is a good way to demonstrate your potential longevity to your insurer.

Family Medical History

Some health conditions are hereditary, meaning that you are more likely to develop certain health problems if close family members have experienced them previously. These can develop irrespective of your general health and fitness level.

A family history of a particular health problem will be included in your medical records, meaning your insurer can take this into account when they offer you a quote.

Drinking & Smoking Habits

In addition to your medical history, insurance companies will also consider potentially unhealthy lifestyle habits when they offer you a quote. In particular, smokers and heavy drinkers are at a much higher risk of developing serious health conditions and are prone to shorter lifespans.

As such, health questionnaires from your insurer will usually cover your smoking and drinking habits, where heavy consumption can make a big difference to your monthly payments.

Occupational Risks

Your policy could also cost more if you work in a risky profession. For instance, those working with heavy machinery, for the fire service or in the armed forces could expect to pay more for their monthly premiums than those who work in considerably safer occupations.

Hobbies

When you apply for a new life insurance policy, your insurer may ask about your hobbies and the kind of recreational activities you undertake on a regular basis. For instance, if you regularly ski, cycle or go on sailing holidays, your insurance may be adjusted to reflect the various risks involved.

Working On Your Health

If you’re thinking about taking out a life insurance policy in the near future, then there are some steps you can take to ensure that you’re in the best possible health. Even if your health changes are fairly recent, showing a lifestyle improvement can make a difference to the projected cost of your policy.

Some simple ways you can work on your health include:

-

Quitting smoking – choosing to quit smoking is one of the best things you can do for your health, and will have a considerable impact on your insurance premiums.

-

Weight adjustments – seek the advice of a medical professional if you feel your weight is having an impact on your health.

-

Staying active – maintaining an active lifestyle will improve your overall health and fitness level, helping to ensure your premiums are kept to a minimum.

-

Controlling pre-existing conditions – showing your insurer that you’re looking after any long-term health problems can help to reduce various risk factors.

-

Limiting your alcohol intake – cutting down on alcohol consumption or seeking support to reduce your intake will also make a difference to your insurance costs.

-

Getting regular check-ups – regular checkups and screenings will help to catch any health issues before they become more serious, keeping premiums to a minimum.

Assura Protect: Offering Long-Term Peace of Mind

At Assura Protect, our members can benefit from modern life insurance policies that are designed to instil long-term peace of mind.

When you choose one of our policies, you will also gain access to our innovative Doctor-on-Demand service. You will have 24/7 access to online GPs, helping you to stay on top of your health and wellbeing.

As part of this service, you will receive 15 minute appointment slots from UK-based GPs, where you can speak to your doctor from anywhere in the world. Our GPs can also provide sick notes, referral letters and e-prescriptions, so you can prioritise your health without delay.

Choose from our Term Life insurance policy, or our Dual Life cover to protect your loved ones and safeguard your finances, where premiums and the cover you can expect to receive will vary depending on your age and health.

If you’d like to receive a dual or term life insurance quote, then you can utilise our Quick Quote service today. You can also speak to our team directly for more information about specific policies.