Moving house is a big financial commitment, especially if you’re looking to take out a mortgage loan. A mortgage is a formal agreement between a homeowner and a bank, where a loan is given so that the buyer can secure ownership of a house without paying the full cost upfront. Once the loan is paid off, the house then belongs in full to the homeowner.

Importantly however, your lender could seize your property if you’re unable to find your mortgage repayments, even if payments are stopped due to illness or loss of life. That’s where life insurance comes in, where taking out a reliable policy can protect your loved ones if you’re unable to make mortgage payments in the future.

Read on to find out more about mortgages and life insurance, with a look at the various policies on offer.

Do You Need Life Insurance For A Mortgage?

Legally speaking, you don’t need life insurance to take out a mortgage. However, there are various financial benefits to be gained from taking this precautionary step. In case of your death, life insurance could be used by your surviving loved ones to pay off your mortgage, or to assist with costs, helping to ensure that your family can remain in their home whilst preserving some financial stability.

You may wish to consider a life insurance policy if you’re taking out a mortgage with your partner. Discuss whether one of you could afford the repayments if the other was to pass away, and how this financial discrepancy may impact quality of life. Without the protection of life insurance, your partner may be forced to sell to cover the loan payments, adding to the stress of an already difficult time.

Additionally, if you’re a landlord who rents out property, then you may also wish to protect your financial investments with some form of life insurance. If some of your assets have been purchased with a mortgage loan, then this can allow your family to continue to benefit in the event of your death. This is distinct from landlord’s insurance, which relates to building cover rather than loss of life.

Types of Insurance for Your Mortgage

If you wish to take out an insurance policy to protect your mortgage, then it is important to understand all your options.

Mortgage life insurance, also known as decreasing term life insurance, is a common policy to cover mortgage payments in the event of a death. Typically, this is seen as a cost-effective option, where the potential payout decreases over time in line with your decreasing mortgage repayment balance.

A level term life insurance policy can also be used for this purpose, where this means that your cover stays the same during your entire policy term. As such, you will be provided with a larger payout in the event of your death, though this policy does tend to require higher monthly premiums.

Other insurance policies such as critical illness cover also provide financial security in the event of your untimely death. Though not linked directly to your mortgage, these payouts can allow your family to continue monthly repayments and maintain their quality of life.

Importantly, life insurance policies are optional agreements that hold no cash value. As such, if no claims are made at the end of your policy you will not receive a refund or a return on your investment.

Assura Protect: Fair & Affordable Life Insurance

At Assura Protect, we offer a range of modern life insurance policies for a changing world. We’re committed to providing our policyholders with the best protection possible, giving you peace of mind for the long term.

A number of our policies can provide financial security to your loved ones if you’re looking to cover mortgage repayments. We personally recommend our Term Life and Dual Life policies for this purpose, where you can find out more about these below.

Term Life Insurance

Our Term Life insurance cover involves regular premium payments in exchange for a defined payout upon the death of the policyholder. This policy also covers terminal illness diagnosis, if the situation falls within our current Terms & Conditions.

The tax free benefit payment can be used by your loved ones for any purpose, where financial sums may be utilised to manage mortgage repayments, funeral costs or other living expenses.

Eligibility & Limitations

Term Life insurance provides protection up to the value of £1,000,000, where your cover may vary depending on your health, age and other factors set out in our Terms & Conditions.

Please note, the maximum term for a Dividend Life Policy is set at 40 years, where the latest your policy term can end is the day before your 90th birthday. As such, there will be no benefit payment if you live beyond the end of your policy term.

Dual Life Insurance

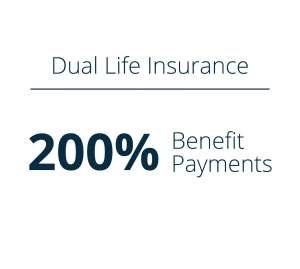

At Assura Protect, we offer our innovative Dual Life insurance policy as an alternative to traditional Joint Cover life insurance. These policies are aimed at couples who share living expenses, where benefit payments can help to cover mortgage fees and other costs in the event of the death of one partner.

Traditional Joint Cover insurance provides a single death benefit payment only, where the policy terminates when one partner passes away. In contrast, our Dual Life policy provides a modern alternative that aims to leave surviving partners better protected for the long term.

Dual Life cover means that each partner is insured separately, so that a benefit will be paid following both deaths rather than just the first. This means that the policy doesn’t end with the death of the first partner, ensuring that the whole family is protected. As such, you can benefit from twice as much cover compared to a traditional policy.

For instance, a £100,000 sum assured policy could pay out £200,000 in total, rather than just the stated £100,000 for the first partner’s death. This can be secured via similar or equivalent monthly premiums to those offered by a traditional policy provider, making for a cost-effective long term investment.

A Lifetime of Security with Assura Protect

Our mission is to deliver customer-focused protection that you can count on, whether you’re looking for mortgage life insurance or critical illness cover. We’ve developed all of our life insurance options in response to the modern world, where we recognise the various financial challenges that our policyholders face in the 21st century.

To help you to feel supported, we provide a Doctor-on-Demand service with 24/7 access to a GP, so you can have confidence in your health and wellbeing. We also guarantee that your policy will be covered by the Financial Services Compensation Scheme (FSCS), giving you extra reassurance that your payments are secure.

If you’d like to learn more about mortgage-related life insurance or any of our other policies, our expert team will be happy to assist you. Simply get in touch today and we’ll provide you with all the support you need.

You can also request a life insurance quote via our website to help you to understand more about the costs involved.