Life is always unpredictable, where it can be hard to anticipate the various highs and lows you’ll experience as you move through the decades. As such, it can help to invest in some security to protect your finances, especially if you’re looking after dependents or paying off a mortgage.

That’s where life insurance comes in, where this kind of cover can assure that your loved ones are entitled to a substantial pay out in the event of your death, or if you experience a serious illness. To receive this, you will contribute monthly payments or premiums, as stated in your policy contract.

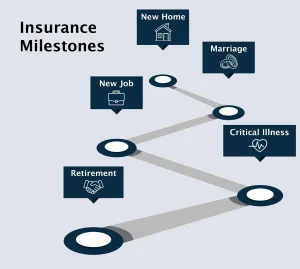

The specific terms of life insurance policies vary between providers, so it is important to read the details carefully before you commit to a long term plan. The policy you take out will also differ depending on your needs, where there are various life milestones that may encourage you to think about a life insurance plan.

Read on for a closer look at when you should take out a new life insurance policy, with an overview of the various plans that may suit your requirements.

Buying A House

Many people consider taking out a life insurance policy when they buy a house, where this can provide a thorough level of financial protection for the surviving party in the event of an unexpected death.

In particular, an insurance plan can protect you when it comes to paying your mortgage if your partner passes away. Some mortgage lenders will require this kind of insurance plan in order to approve your loan, as this will ensure that payments can still be made if the main contributor loses their life.

Taking out insurance at this stage can help your dependents to feel secure and protected for the long term, where a payout can ensure your family won’t have to sell their house in the event of your death. This is important for providing stability at a difficult time.

For those taking out life insurance to cover their mortgage, a decreasing term policy is usually a top choice. These tend to be cheaper than alternative life insurance policies, where your cover will decrease over time as you pay off your mortgage loan.

Marriage

If you’re about to get married or make a life-long commitment to your partner, then this may be a good time to think about a dual life insurance policy. If you have separate policies, it might be more cost effective to take out a combined policy, especially if you intend to pay your premiums together.

Additionally, you may wish to increase the cover on your individual policy when you get married. This can help to ensure that you have financial security as you invest in property or prepare to support dependents for the long term.

Growing Your Family

Many people decide to take out a life insurance policy when they start a family, as your financial responsibilities will change considerably at this time. If you have children and a spouse that you support, then these dependents will be protected by a life insurance plan, helping to ensure that they can preserve their quality of life in the event of your death.

It may be beneficial to take out an additional critical illness policy at this time, or to choose a life insurance plan that includes this. If you are unable to work due to a serious illness or as the result of an accident, any dependents will be able to retain financial security.

New Career

Some companies offer a specific ‘death in service’ benefit, where this means that a named person will be paid a lump sum if you die whilst working for that employer. This is distinct from a life insurance plan, as it is at the behest of your employer to decide on the terms of your payout.

If you’ve recently moved jobs and no longer have this protection in place, then you may wish to take out a new life insurance plan at this time.

Critical Illness

It is impossible to anticipate whether you’ll experience a critical illness at some stage in your life, where this is usually a long-term or very serious condition. However, if you have a family history of a particular illness, if healthcare is not affordable where you live, or if your employer doesn’t offer adequate sickness benefits, then you may wish to take out this kind of policy.

Some plans offer a one-off payment if you’re diagnosed with a critical condition, whilst others will provide multiple benefits. It may also be more cost effective to combine critical illness cover with a new or existing life insurance plan.

Retirement

Retirement is another milestone that may cause you to reflect on your finances. If your children no longer depend on you for financial support, then you may wish to reduce your cover.

However, if you do still have dependents, or you’re concerned about funeral costs, then life insurance can help to ensure that your loved ones are properly looked after.

Assura Protect: Modern Life Insurance That Works For You

At Assura Protect, our goal is to provide you with a quality life insurance plan that suits your requirements. We offer competitive premiums and a range of policy benefits, where all our policies are built to instil lasting peace of mind.

Our top policies include:

Term Life Insurance

Our Term Life Cover allows policyholders to make regular premium payments in exchange for a defined benefit upon the death of the policy holder. The exact amount of cover you receive will vary depending on your age, health and additional assessment criteria.

Importantly, the latest your policy term can end is the day before your 90th birthday. Term Life insurance also has no cash value, and there is no benefit payment if you live past the end of your policy term.

Multi-Claim Critical Illness Cover

Traditional critical illness plans pay out a lump sum if you’re diagnosed with one of the illnesses covered by your policy. In contrast, our Multi-Claim Cover can allow you a maximum of three major conditions claims per policy, where these benefit payments are tax free and can help you to cover a range of financial burdens.

Our Critical Illness plan covers 40 major health conditions, with 6 partial conditions also covered. A complete overview of these conditions can be found in our Policy Guide, where long-term conditions can include cancer, organ failure, strokes and disability.

You can also take out our Dividend Life insurance with 200% Multi-Claim Critical Illness Cover, where this means your policy will continue after the initial benefit payment has been made.

Dual Life Insurance

If you take out a traditional joint life insurance policy with your partner, then this policy will terminate when one party passes away, providing a single death benefit only.

Instead of this, Dual Life Cover with Assura Protect pays a benefit upon the death of both parties, not just the first, where protection for the survivor remains in place.

If you’d like to learn more about any of our policies, then get in touch with one of our expert team members, or request an insurance quote online today for a better understanding of the costs involved.