Starting a family is a new and exciting time for couples, and the beginning of a new chapter. There are many considerations for soon-to-be parents to make ahead of welcoming their child, so that they can stay prepared. Navigating the responsibilities of raising a child can seem daunting, and having children requires proper financial planning ahead of time. It’s important for parents so consider their health, and even reconsider their life insurance plans. Our blog takes a look at the importance of reassessing your life insurance plans as new, or soon-to-be parents. To learn more about how life insurance will impact your children in the future, keep on reading.

Understanding Life Insurance

Life insurance is a type of insurance cover that pays out either a lump sum, or regular payments to your dependents if you die. These policies are designed to help families by providing extensive protection in the event of your death, ensuring that your family has financial protection and stability.

The amount of money paid out in the event of your death will depend on the level of cover that you choose. You will have full control over how your life insurance is paid out and whether it will be used for specific payments, such as a mortgage, rent or education.

Two of the main types of life insurance that you may come across are:

Term Life Insurance Policies

-

These policies run for a fixed amount of time

-

They are often chosen by those with chronic conditions or terminal illnesses

-

They typically run for 5, 10 and 25 years

-

These policies are only paid out if an individual dies during the policy

Whole Of Life Policy

-

This policy will pay out no matter when you die

-

Premium payments must be kept up, otherwise there will be no payout at the end of the policy

-

Individuals have more control over lump sums/regular payments at the end of the policy

Who Would Need To Have Life Insurance?

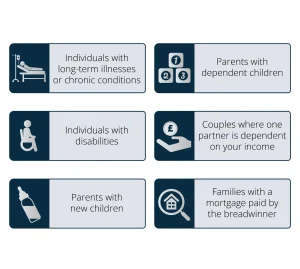

Every household, relationship and family is different, however there are many households that decide to take out life insurance to protect their family in the future. So, who needs life insurance?

For first time parents and growing families, taking out life insurance is important for your children’s future and stability, in the event that they lose one or both parents. Life insurance policies are designed to help you provide for your family in the event of your death, leaving them financially stable.

Why Is Life Insurance Important For My Family?

Becoming a parent for the first time and growing your family is an exciting time for any couple. However, there are financial considerations to make to protect your children later down the line. Life insurance is a type of financial cover, which is paid out to your dependents when you die, either in a lump sum or regular payments. Life insurance plans are beneficial to families in a range of ways, including:

-

Mortgage, Rent & Bills – In the event of your death, your life insurance payout could mean that your family and loved ones have the finances to continue paying a mortgage, rent or bills, keeping a roof over their head.

-

Children’s Future – Long term needs such as education, hobbies and childcare can be expensive, and the financial pressure can be even more strenuous after one parent has passed away. Life insurance plans ensure that your family has the necessary funds to fulfil these long term needs.

-

Stability & Reassurance – In the event of one or both parents passing away, life insurance plans give reassurance and financial stability, even when you are no longer there to provide.

Dual Life Cover With Assura Protect

When couples become more serious and have more joint commitments, such as mortgages, housing, or are married, the need for single life insurance cover decreases. Instead, many couples and new families decide to take out dual cover or joint life insurance cover, which covers both partners in the event of death. We’ve broken down the key aspects of both traditional joint cover life insurance, as well as Assura Protect’s Dual Life Cover, so that you can gain a deeper understanding of these options.

Traditional Joint Cover Life insurance

In couples where the household income, expenses and mortgage are managed together, couples often want to choose insurance policies that coincide with their combined financial planning. Traditional joint life policies can work well for families who are planning ahead and looking for shared security.

These policies cover the ‘first life’, of the first partner who passed away, and the payout chosen by the couple will be given to the beneficiary, who is typically the other partner. This policy may work for families where one partner has a chronic illness or serious condition, as there is only a single death benefit payment. The policy, in most cases, will also terminate after the ‘first life’ payout has been made.

Dual Life Cover With Assura Protect

For couples who are looking for secure, combined protection, Assura Protect has an ideal solution. The Dual Life Cover provided by Assura Protect, rather than traditional joint life cover, offers dual protection for both partners rather than just the ‘first life’. Our Dual Life Cover insures each partner separately, meaning a benefit will be paid in the case of both deaths, not just the first. When a partner passes away first, their partner remains protected financially due to the dual life cover. If, and when, both parents have passed, the beneficiary will receive a payout for the ‘second life’.

Our policy allows you to name separate beneficiaries for each benefit payment, ensuring twice as much effective cover. This can help families by simplifying estate planning and arrangements after death. Our Dual Lift Cover is available on all Assura Term Life and Multi-Claim Critical Illness Policies.

Assura Protect: Joint Cover Life Insurance For Your Protection

To learn more about any of our life insurance policies, feel free to browse our website to learn more. Whether you’re looking for dual life cover, a joint life insurance policy or other life insurance plans, we are here to help. For further enquiries regarding any of our policies or any general questions you may have, get in touch with our team for more support today.