Most of us will change jobs at least once during our lives. While this is an exciting milestone, it’s important to find out how a new job could impact your life insurance policy. Understanding these effects can help you make informed decisions about your life insurance.

This article will describe how changing jobs can affect your life insurance policy. It will outline the advantages and disadvantages of employer-provided life insurance compared to independent life insurance and provide guidance on how to adjust your life insurance when transitioning to a new job.

How Can a New Job Affect Your Life Insurance Policy?

Whether a new job affects your current life insurance policy depends on a variety of different factors, including the type of policy you possess and the terms set out by your life insurance provider.

Employer-Provided Insurance

If you have independent life insurance that was purchased outside of work, nothing will automatically happen to your existing policy unless you choose to make changes to it. However, most employer-provided life insurance plans are only available to current employees. If you received group life insurance coverage through your previous employer, it will terminate on your last working day. Therefore, you will need to find a new policy when you switch jobs.

Salary Changes

Many life insurance policies are linked to your annual income as they are designed to replace your earnings in the event you pass away. If you experience a significant salary increase when switching to a new job, review your coverage to ensure your new financial situation and responsibilities are accurately reflected in your life insurance policy.

On the other hand, if you experience a salary reduction, it may be possible to lower your life insurance costs by modifying your coverage. However, make sure any coverage changes still meet your needs and the needs of your dependents to avoid leaving your family underinsured.

Taking Time Off

Taking time off from work, whether for a sabbatical, maternity leave, or other reasons, can affect your life insurance. Irregular income can make it challenging to keep up with premium payments. Some insurance providers may offer policyholders a payment holiday, enabling them to pause their insurance premiums for a specific period. If you are unsure whether your provider offers this, contact your life insurance provider to find out whether this could be an option for you.

Risk-Level

Life insurance premiums are typically higher for individuals in high-risk professions, such as emergency service workers, due to the increased likelihood of needing to make a claim. If you are switching to a job with a higher or lower level of risk, this could affect the cost of your insurance. It’s important to discuss this with your provider to determine whether your current policy is still the most suitable for your new occupation.

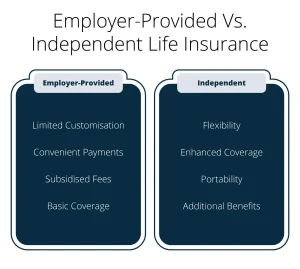

Employer-Provided Life Insurance vs. Independent Life Insurance

Getting your life insurance through an employer as opposed to taking out an independent policy brings different advantages and disadvantages. Looking at the following pros and cons of each life insurance type can help you decide which option is right for you.

Employer-Provided Life Insurance

Many employers offer life insurance as part of their benefits package, which provides a basic level of coverage at a reduced rate or free of charge.

Pros:

-

Price: Life insurance may be partially or fully subsidised through your employer.

-

Basic Coverage: Typically, a subsidised policy offers a basic level of coverage, which can be upgraded for a reduced rate through an employer plan.

-

No Medical Exam: Generally, a medical exam or a detailed health history isn’t required to qualify.

-

Easy Payments: Premiums are deducted directly from your paycheck, making it easy to keep up with payments.

Cons:

-

Limited Coverage: The amount of coverage might not be sufficient and could leave you underinsured.

-

Portability Issues: employer-provided policies are terminated upon leaving a job, requiring you to seek another policy, or you will be left without life insurance coverage.

-

Lack of Customisation: Group insurance is usually a one-size-fits-all plan, with limited options for adapting coverage to your specific needs.

Independent Life Insurance

Independent modern life insurance policies, like those offered by Assura Protect, can provide diverse advantages over employer-provided plans.

-

Customisable Coverage: Choose coverage amounts and modern life insurance types that best meet your individual needs, including flexible term life policy, whole life, or critical illness cover.

-

Portability: Coverage remains intact regardless of job changes or periods of unemployment.

-

Potential for Better Terms: Independent policies may provide better terms, depending on your health and financial situation.

-

Life Insurance with Living Benefits: Independent modern life insurance often comes with additional living benefits, such as digital GP services for policyholders.

Switching Life Insurance When Changing Jobs

Review Your Plan

If you are currently enrolled in an employer-provided life insurance plan, you must review your current policy before your termination date. Find out whether you can continue with the plan – if so, how would coverage and costs be affected by a new job with a different salary and responsibilities?

Consider factors like coverage amount, premiums, and policy terms to decide whether your current policy is adequate or if adjustments or a new policy with another provider might be beneficial.

Seek Professional Advice

Consulting with an expert insurance adviser can provide valuable insights into how a job change affects your life insurance needs. They can help you navigate options, compare policies, and choose the best coverage for your new employment situation.

The Changeover Period

Once your leaving date has been confirmed, prepare your life insurance changeover ahead of your last working day to avoid a coverage gap. This may involve arranging a new independent policy or transferring coverage from one employer-provided plan to another if you have another job lined up for immediate start.

Modern Life Insurance at Assura Protect

At Assura Protect, we offer a range of life insurance plans tailored to diverse needs and circumstances. Our policies can be customised based on coverage amount and term length or include additional features like critical illness coverage.

Dividend Term Life Policy

Our Dividend Term Life Policy combines term life coverage with the potential for accumulating annual dividends. Along with a guaranteed death benefit, the policy also allows policyholders to earn dividends over time. Dividends can be reinvested in the policy for added value, withdrawn or used to cover future premiums. Comprehensive protection and financial growth opportunities make it a rewarding life insurance policy.

Multi-Claim Critical Illness Cover

Our Multi-Claim Critical Illness Cover offers extensive protection against severe health conditions, enabling policyholders to make multiple claims throughout the policy duration. A key feature is the 200% Multi-Claim coverage, which doubles the sum assured for subsequent claims, providing financial security. The policy also includes a “reset” feature, restoring the sum insured after each claim, ensuring continuous coverage and long-term protection against the financial strain of multiple critical illnesses.

Policy Benefits:

-

Financial Protection: Comprehensive coverage for death or critical illness, ensuring financial security.

-

Flexibility and Enhanced Coverage: Offering 200% Multi-Claim Critical Illness Cover and 200% Dual Life Cover.

-

Potential for Financial Growth: Opportunity to earn and reinvest dividends with Dividend Term Life.

-

Life Insurance with Living Benefits: Membership benefits support policyholders to maintain a healthy lifestyle. These benefits can include access to wellness programs and discounts on health-related services.

-

On-Demand Digital GP Services: Policyholders have access to 24/7 Digital GP Services, offering peace of mind and immediate medical support without the need for in-person appointments.

To learn more about the range of modern life insurance policies available at Assura Protect, don’t hesitate to get in touch!